“I bought my home a few years prior to marriage. We are divorcing in Minnesota after eight years, and only my name is on the title. Does that effect the equity claim?”

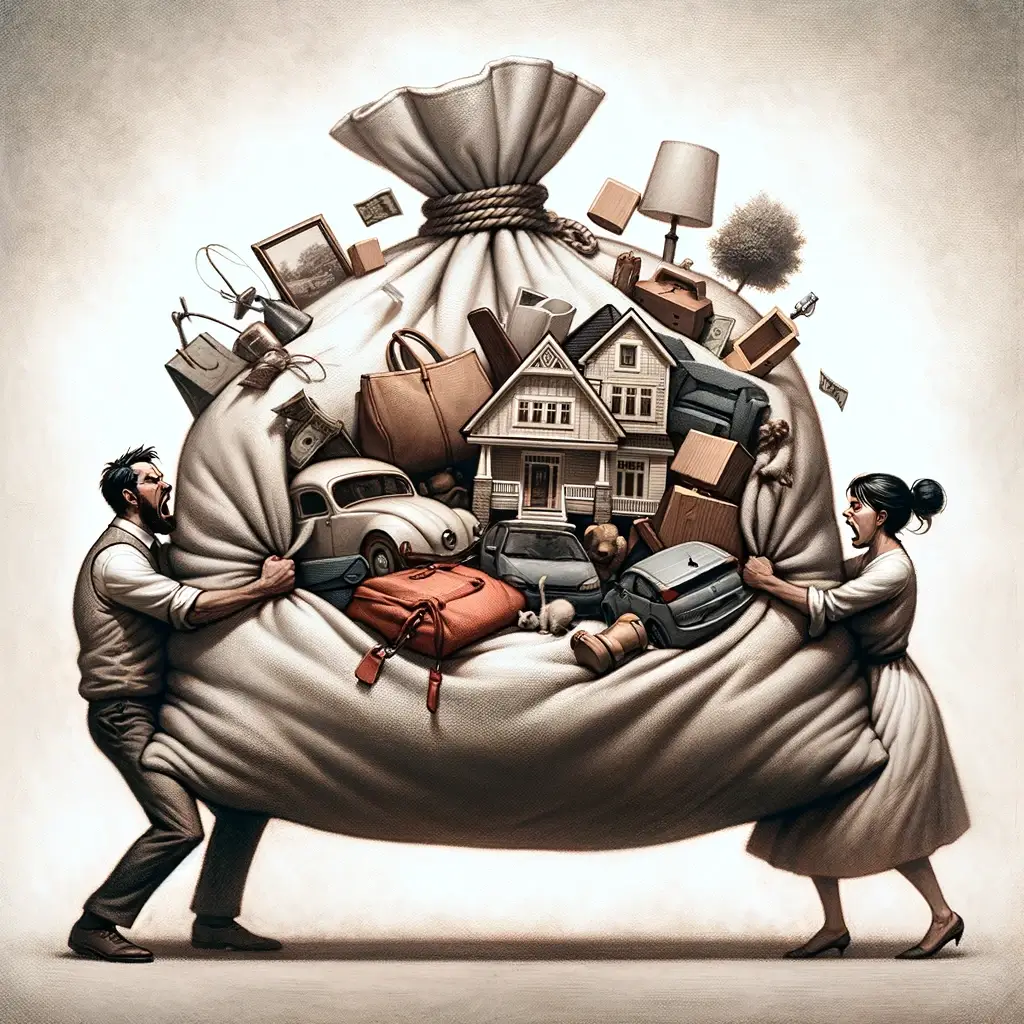

We frequently get asked by those involved in a divorce whether the assets they owned before their marriage can be claimed by their spouse as ‘marital property’ or whether the assets are ‘untouchable’ because they are truly nonmarital property.

To complicate matters even further, what if the asset increased in value during the marriage? Does that increase in value become marital property?

And to complicate matters even more, what if the increase in value resulted from contributions or efforts made by the spouse?

Can your spouse then make a claim that the asset is now completely marital property because he/she helped increase the value of the asset?

Let’s take a look at the issue and how we guide clients when evaluating marital property versus non-marital property, plus take a look at some examples of non marital property.

Marital vs. Non-Marital Property

Thankfully, Minnesota law is not complicated in explaining the difference between a marital asset (which a divorce Court has authority to divide between spouses) and a non-marital asset (which a Court generally does not have the authority to divide during divorce proceedings).

The entirety of these assets and value are considered the marital estate. Property acquired during the marriage is typically part of the marital estate.

In Minnesota, a divorce court is required by law to assume that everything that one spouse owns is also owned by that person’s spouse. The state strives for equitable distribution during divorce property division.

This means that the burden of proving that the asset is ‘non-marital’ is on the spouse who wants the court to consider the asset to be ‘non-marital’.

Marital debts, marital funds, real property, investments (including retirement plans) real estate, businesses – it all gets considered.

Here are some examples of property that a court will consider to be untouchable or “nonmarital.”

Non Marital Assets Can Include:

-

Property gifted from a third party to one but not the other spouse. This could be a gift or inheritance.

-

Property obtained before marriage.

-

Property acquired by a spouse after the divorcing spouses have been to court and identified to the court all of the marital assets which they wish to divide.

-

Property that is considered untouchable by a valid prenuptial agreement constitutes non marital property

-

Property that is acquired in exchange for any of the items listed above.

(in-part from —Minn. Stat. Sec. 518.003 subd. 3(b))

Importantly, property acquired before a marriage that is then co-mingled with marital property can then be considered marital property. A good example is cash in a bank account that gets added to a new jointly owned bank account after marriage. This is now generally considered marital money.

So, even though you might have a car (or a house) that is titled solely in your name, if you are married and getting divorced, a Minnesota court will assume that your house and car are also the property of your spouse – UNLESS you can prove that one of the exceptions provided above applies. Personal property is no exception.

Some Real-World Examples of Marital vs Non-Marital Property

Retirement Accounts and Pensions

Even if a retirement account or pension is in one spouse’s name, the portion of the benefits accumulated during the marriage is typically considered marital property. This includes 401(k) plans, IRAs, and other retirement and pension accounts. The idea is that both spouses contribute to the financial well-being of the marriage, directly or indirectly, making such assets subject to division upon divorce.

Commingled Property

When a spouse mixes non-marital (separate) assets with marital assets, this property can become “commingled” and thus considered marital property. For example, if a spouse receives an inheritance (normally considered non-marital property) and then deposits it into a joint bank account used for marital expenses, the inheritance may lose its non-marital character and be subject to division upon divorce.

Gifts Between Spouses

While gifts received from a third party to one spouse are typically considered non-marital property, gifts given from one spouse to another during the marriage are often treated as marital property. This can include jewelry, cars, or any other significant purchases made for one spouse using marital funds. The rationale is that these gifts were intended for the benefit of the marriage or were acquired with marital resources, making them subject to division.

Intellectual Property Rights

Intellectual property (IP) rights like royalties from a book, patent, or trademark developed during the marriage can even be considered marital property. Even if the IP is registered in the name of one spouse, the income derived from this type of property during the marriage, or the increase in value of those rights due to marital effort or investment, is often subject to division. This is because the creation or enhancement of the IP’s value is seen as a contribution by both spouses, directly or indirectly, to the marital estate.

Non-Marital Value Increases as Total Value Increases

But, what about the asset increasing in value because your spouse contributed to the increase?

What if your spouse helped you pay down the mortgage on your house so that you have more equity than you did before getting married?

What if your spouse helped pay for a deck or a new roof on the house that increased its value?

There are some assets that we own, such as a house, that are usually tied down with an encumbrance or lien, such as a home mortgage. The question then becomes, how do we measure an increase in value of a non-marital share (the equity you have in the home at the time of marriage) while still measuring any increase in value that occurred because of the marriage (your and your spouse’s contributions to the mortgage payments)?

Does it complicate matters because the divorce court has to consider the mortgage too when determining the non-marital and marital values?

The answer is ‘no’, not really.

The Schmitz Formula

The Minnesota Supreme Court in Schmitz v. Schmitz—309 N.W.2d 748 (Minn. 1981) applied a formula similar to one used by the Kansas Supreme Court, in figuring out how to give credit to an increase in value of a non-marital interest in the house, while still acknowledging that there was a marital interest in the house, because of the mortgage being paid down by the parties during the marriage.

Today, this is called the Schmitz Formula.

Here is what the Court did.

It considered the non-marital equity in the house, and the percentage increase in the total market value of the house during the marriage. The Court then increased the non-marital equity in proportion to the home’s increase in value. The Court then, subtracted from the home’s total value the amount of the mortgage and the non-marital equity.

What was left over was the marital value, which the court could then divide between the parties.

A House Divided Equitably: Property Division in Minnesota

As an illustration, consider that a couple is going through a divorce, and they own a home which the wife purchased before marriage.

The couple wants to know how much of the house, if any, is marital, and how much of it is non-marital during the division of property.

Say the house was worth $100,000 at the time of the marriage and there was a $90,000 mortgage against it at the time of marriage.

At the time of the divorce, the home had doubled in value, and, the mortgage balance is now down to $30,000.

According to Schmitz we should determine the non-marital interest as follows:

| Time of Marriage | Time of Divorce | |

| Value of the House | $100,000 | $200,000 |

| Mortgage Balance | $90,000 | $30,000 |

| Equity | $10,000 | $170,000 |

| Non-Marital Equity | $10,000 | $20,000 |

| Marital Equity | $0 | $150,000 |

The moral of the story is: the non-marital equity increases according to the increase in the asset’s – in this case the home’s market value).

Minnesota Family Law Attorneys: Helping You Navigate Property Division

If you have questions about a non-marital asset or interest that you wish to ensure is considered separate property during your divorce, our experienced divorce team right here in the Twin Cities would love to help.

Please feel free to contact our team at 952-800-2025 or reach out via our online contact form for a free consultation and conversation. We look forward to hearing from you.